IRAN ART EXHIBITION: DON’T FORGET ABOUT DESIGNING A SALES INVOICE FOR YOUR SMALL BUSINESS

A sales invoice is an accounting document that records a business transaction. Sales invoices provide the business with a record of the services they’ve provided to a client, when the services were rendered and how much money the client owes the business. Typically, a sales invoice will include a description of the service provided, the amount owed and the deadline for payment. Sales invoices are crucial to small-business accounting because they enable you to record transactions of your sales for bookkeeping purposes.

Why Are Sales Invoices Important for Small Business Accounting?

While the primary purpose of a sales invoice is to request payment from a client for the services you provided them, a sales invoice serves other important functions in small business accounting, including:

1. Foundation for Accurate Bookkeeping

Sales invoices are an important tool for small businesses because they serve as the foundation for the business’s bookkeeping system. A sales invoice creates a record of a sale. By properly recording and filing all the invoices you send to clients, you’ll have all the information you need to track your sales, monitor your cash flow and create robust financial reports.

2. Resource for Tax Returns

Sales invoices are crucial documentation for verifying the claims you make on your tax returns. The IRS recommends that small businesses keep supporting documents like invoices in a central place, in case you need to confirm the information you include in your company’s books. You can refer to the full list of supporting business documents recommended by the IRS for more details. Properly recorded invoices also make the process of completing your tax returns easier, since you’ll have a complete record of your business’s revenue and expenses.

3. Inventory Management Tool

IRAN ART EXHIBITION: If your business sells physical products to its customers, your sales invoices can help you manage your inventory and ensure you always have enough of each product to fulfill your incoming orders. Your sales invoices help you track how much inventory you have on hand and allow you to forecast how much you’ll need for future months, based on past data.

4. Legal Protections

Your sales invoices can help protect you from petty or unsubstantiated lawsuits that may be brought against your company. Sales invoices can demonstrate what services your business provided to a client and the timeline for the work. Sales invoices that are signed by clients are particularly useful in this instance, but not necessary.

5. Data for Business Plans

Sales invoices serve as important data when your business is planning for its future. Sales invoices can offer information on how much revenue you’re bringing in and how your earnings have changed over time. You can use that information to do budget forecasting. You can also use your sales data to see how much cash you have available to invest in growing or improving your business. Sales invoices detail all the different services you’ve provided to clients, so you can see which are your most popular offerings and which services are not generating as much income. With that information, you can make decisions on how to update your business offerings to make your company more attractive to potential clients.

A sales invoice is just one type of invoice you can generate to seek payment from a client. Learn about the different types of invoices you can use to get paid on time for your work.

What Is the Purpose of a Sales Invoice?

IRAN ART EXHIBITION: The purpose of a sales invoice is to detail the services a business provided to its client, the amount owed for these services and the deadline to make a payment. Sales invoices create an obligation on the part of the client to pay the business for its work. They serve as important documentation of a business transaction both for the business and the client and act as the foundation for a company’s financial statements.

How Do I Make a Sales Invoice?

To make a sales invoice to send to clients, you’ll need to follow these invoicing steps:

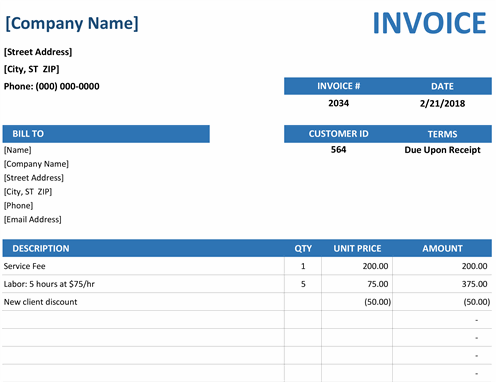

1. Include Your Business Details

Create a header for your invoice that includes your logo, if you have one, your business name, address, phone number and email address.

2. Include Your Client’s Contact Information

IRAN ART EXHIBITION: Below your own contact details, list the client’s contact information. Confirm that you have contact details for the correct contact person within the organization: if your client is a large company, your point of contact for invoicing might be different than your day-to-day business contact.

3. Assign an Invoice Number

Every invoice that you issue should have a unique invoice number assigned to it. That way, you can easily track your invoices and reference specific sales invoices in discussions with your clients. If you don’t have a numbering system in place, it’s easy to start by numbering your sales invoices sequentially, beginning with Invoice # 001, then Invoice #002 and so on.

4. List the Services You Provided

Provide an itemized list of the services you provided on your sales invoice, with a brief description of each service, the quantity supplied or hours worked, and the rate for the service.

5. Include Payment Terms

Outline the payment terms on your sales invoice, including the payment methods you accept (i.e. cash, check, credit card, etc.) and any late fees you’ll charge on overdue invoices.

6. Provide a Payment Due Date

Clearly list the deadline for payment on your sales invoice. It’s best to list an exact date, i.e. “Payment Due October 31, 2018” rather than more vague due dates that can be misunderstood, i.e. “Payment Due in 30 Days” or “Payment Due Upon Receipt.”

7. List the Total Amount Owing

Provide a total balance due on the sales invoice, including any applicable taxes. Make sure this information is clearly displayed on the invoice so your clients can see how much they owe at a glance.

Sales Invoice Template

IRAN ART EXHIBITION: To easily design and create sales invoices for your business, you can download sales invoice templates and customize them to suit your needs.

What’s the Difference Between a Sales Invoice and Sales Order?

Both sales invoices and sales orders are used for accounting purposes, but the main difference between a sales invoice and a sales order is their point of origin. A customer creates a sales order when they purchase goods or services from a business. A sales invoice is created by the business after they’ve provided products or services to a client, as a way to request payment.